The Rotation : Endgame

I’ll preface this write up with the fact that this is not meant to be trading or financial advice. These are opinions from the perspective of a technologist attempting to make sense of network architecture road maps and design while taking into account the directions of capital allocation that have happened over the last couple years. Take from this what you will; risk on/off accordingly.

Intro

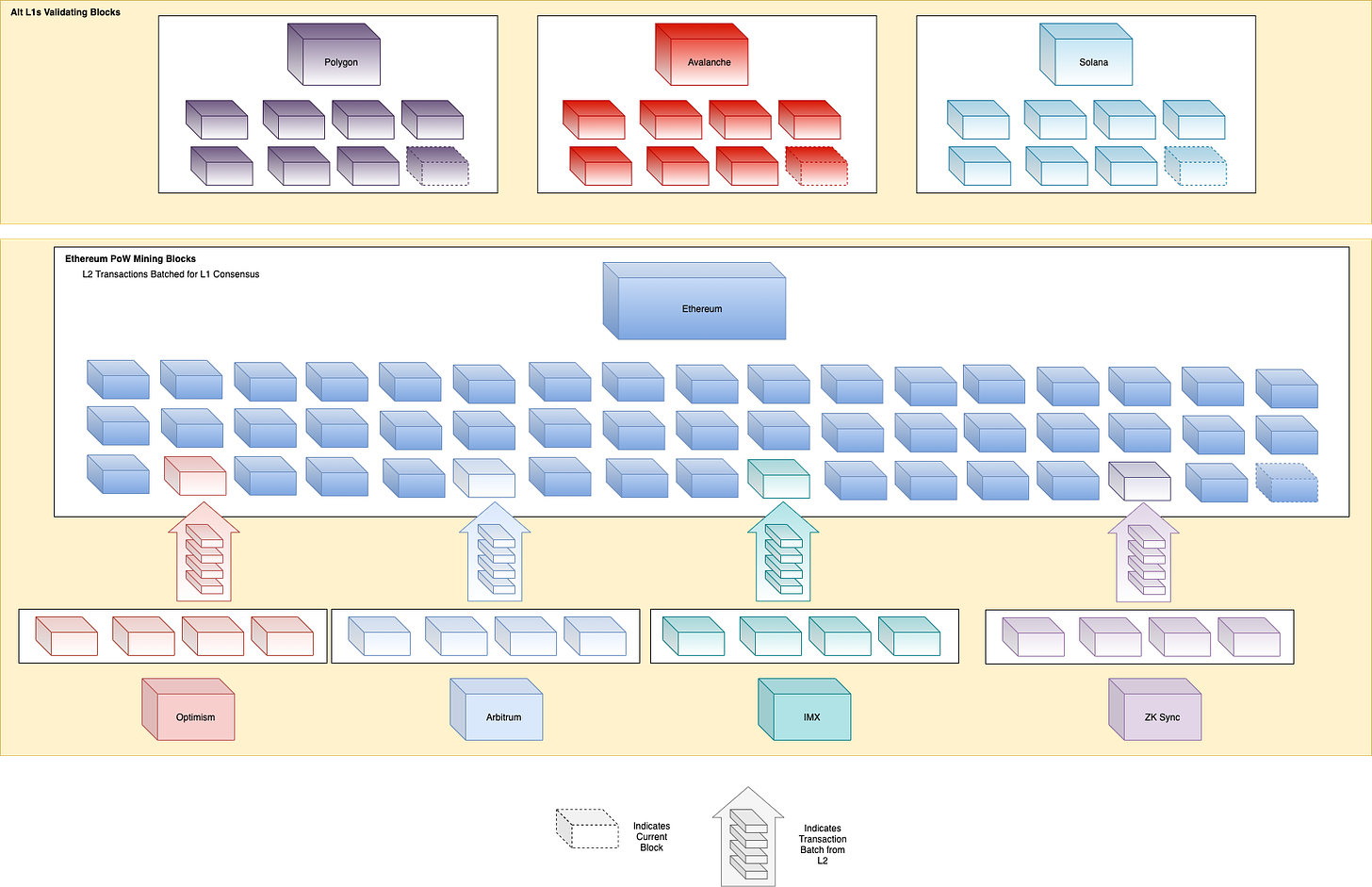

The adoption of alternative Layer 1s (Polygon, Solana, Avalanche, etc.) in 2020-2021 made for an interesting technological and also trading year where capital was rotating in and out of these ecosystems with great efficiency. Early adopters were happy to be in position and ride the wave up while secondary and tertiary waves of investors poured in to capture the next leg of returns compounded with LP rewards incentives. Timed well, you could multiply returns by seeing when liquidity was leaving one network and moving to another then rinse and repeat.

Towards the end of Q4, with Optimistic and Zero Knowledge Layer 2s just starting to pick up momentum, new L1s were able to occupy a market demand that had millions of users with an appetite for DeFi but priced out of using Ethereum mainnet. However, recent scaling/stability issues and rewards tapering as alt L1s pick up on that demand and price volatility across the entire sector have left things in a bit of a “What’s next?” mode.

So what is next?

My guess: massive capital rotation back into the Ethereum ecosystem that might be home for good.

Current State

So what does current state look like? Currently we have Layer 2s quietly (depending on who you ask) porting over and shipping L2 native projects that are slowly but surely occupying more and more block space. Alt L1s are continuing to build at a rapid pace and trying to maintain incentivized retention to keep liquidity from bridging out.

NOTE: For brevity, this isn’t capturing all chains nor Layer 2s. Each L2 is batching transactions into pretty much every block but it is clearer to illustrate that as individual color coded blocks.

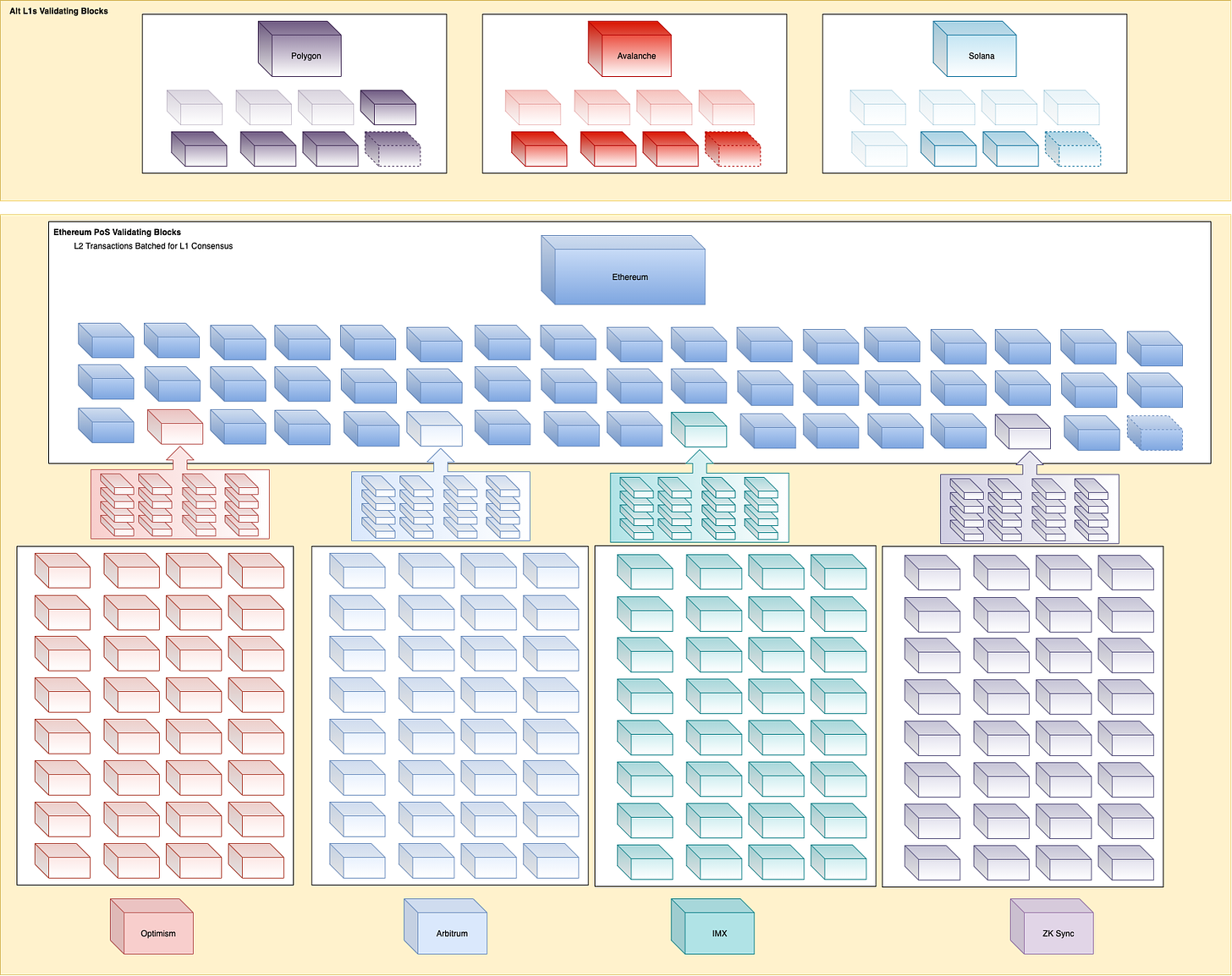

Future State

Even with the current market conditions, at the rate of adoption and cadence that projects are shipping at, we’re looking at a scaling shift that looks like something below:

How do we get there?

Execution. While the ETH 2.0 merge to Proof-of-Stake will definitely occur, the dates are somewhat up in the air right now with debates about if it will even happen in 2022. That aside, whenever that timeline does become known, execution of that and progress of the supplementary L2s will be crucial to determining the time horizon for how quickly we see this rotation occur and, most importantly, stick around for the long haul.

Admittedly, a lot of that is more or less common sense for just about anything from a technology launch perspective. However, the delivery confidence Ethereum would create in the paradigm shift for its network is what would also dissolve any doubts currently creeping in from alternative monolithic L1s that seem to be repeating the “ETH Killer” narrative from back in the 2017-2018 era.

That level of confidence is now what creates a clear direction for companies to begin developing on hardened infrastructure that will be battle tested and ready for the next generation of dApps. That can’t be overstated so more on that later. Not only because of technological clarity but also because L2s will make it so much more cost effective to develop products that have the security assurances of Ethereum. This will drive up L2 transaction demand, which results in L1 block space demand, and finally drive up demand for ETH as the essential fuel for Web3.

What changes?

At this point, I believe we are all familiar with the “Ultrasound Money” thesis that has been discussed for years. Even more so, since EIP-1559 was implemented, we’ve been able to enjoy watching ETH burn on a block-by-block basis.

So, the ETH 2.0 summary:

✅ ETH is burned with every transaction

Ethereum becomes deflationary (issuance reductions) with burns outpacing issuance

No more Proof-of-Work miners means no more forced selling to cover operating costs (electricity, GPUs,etc.)

A large amount of supply is locked up is staking for validators

Worth noting, Ethereum is already seeing net deflationary weeks even prior to ETH 2.0 being implemented.

Neat.

We know all that. What else changes?

Well, this is where it gets fun. We’re now talking about the situation where Ethereum further cements its dominance and the vision of a modular blockchain is now a reality. A Layer 2 first user experience is now common place or seamless to the point where the user isn’t even aware that they are on a L2 that is reporting its transactions to the L1. They just know they get to participate in the decentralized economy and the transactions are fast and cheap but their assets are ultimately tied to Ethereum.

At the same time, dApps are either migrating to L2s or launching for the first time on a L2. This is not unlike 2020-2021 where we saw fork after fork of applications get rebranded and stood up on other EVM compatible L1 chains and incentivize users to bridge over for high yields and early adoption rewards. In that case we all wanted to do more on-chain, saw the incentives, and immediately knew how to use the applications because we’d seen them before. We all wanted to experience Ethereum on Ethereum but unless it was high conviction long term staking or a L1 asset you were trying to get in early on with Uniswap, you were keeping your assets put to avoid gas fees.

This time around, we’ll be having a similar rotation and be able to experience Ethereum but stay on Ethereum; the endgame rotation.

The Endgame

Right now, liquidity is heavily fragmented across all L1s and for good reason. The farming, newly launching projects, and “early adoption” feel is keeping things firmly in place while Ethereum moves along on its road map. As we approach The Merge, L2s will likely have a substantially larger dApp portfolio with new project ideas due to L2 through put, L1 protocols that have migrated, or even cloning some of the innovative ideas that have come from the other L1s that have immediate product market fit. At the moment, admittedly, that list is somewhat thin but growing at a very rapid clip with 2022 expected to be a year where we see projects constantly shipping.

✅ New projects and early adopter incentives.

Where capital becomes re-concentrated is when Web2 organizations now realize Ethereum is a stable infrastructure provider instead of just a cryptocurrency. You don’t need to worry about centralization, block mining being halted, or sending out 10 different RPCs for your users in Discord to try when high volume and/or spam hits your network.

You can liken this to when cloud computing initially started becoming mainstream. Most IT departments were skeptical or costed out of moving infrastructure off premises. Now its basically a no brainer and your toughest decision comes down to Azure or AWS (... maybe Google Cloud)? In similar fashion enterprise organizations will not be willing to gamble their bottom line on a blockchain that has outages, security leaks, or the inability to scale.

✅ Rigid blockchain infrastructure.

The final move to check mate will be when L2s can dispel with the narrative that they cannot have fees that can compete with a monolithic alt-L1. As Optimistic Rollups are continually optimizing their execution to reduce gas fees and some ZK Rollups are even making transactions free and simply eating the gas costs for their users (Immutable X), the reason to venture out and build elsewhere becomes less practical. Imagine the Immutable X model being the norm where development studios will cover the execution fees in order to attract users to their platform. The result is buy and burn pressure on ETH in massive quantities.

✅ Low/no fees and massive scaling.

This is where I can see the moat begin to form around Ethereum for the long term. New systems shipping weekly with low cost barrier to entry for users to try, traders and degens shifting massive amounts of liquidity into where the volume is, and blocks jam packed with transaction batches from L2s to drive all of it. The common denominator in all of that being ETH. Think of every car driving on the highway right now and the only thing that can power them is Ethereum brand fuel. The difference this time is the subsidies and cost savings you can get for using a different fuel are no longer worth your time, so why change?

✅ ✅ ✅ Moat.

Conclusion

Again, none of this is with out risk. Road map delays, L2 stability issues, Merge bugs, etc. could de-rail any of this. This is looking at things as if the execution and timeline of everything all hold within reasonable time frames and probability. Could Polygon and its many ZK acquisitions pan out and rise as a viable competitor? Maybe. Does Solana optimize and aggressively decentralize before The Merge? Possibly.

With Ethereum potentially wielding such a big stick, what happens to these other L1 ecosystems? To be honest, hard to say. I wouldn’t go as far to say there will be nothing but ghost chains but rather one or two chains that wind up pivoting and finding a niche market. Ultimately the ones that remain will inevitably find interoperability with Ethereum natively instead of just being a place to bridge back and forth.... or this all goes to zero tomorrow.

Thanks for reading,

-0xD